21+ Early mortgage payoff

The additional amount will reduce the principal on your mortgage as well as the total amount of interest you will pay and the number of payments. For example if you have a 30-year fixed-rate mortgage for 300000 at a mortgage rate of 5 and you make regularly scheduled payments you will pay 1610 each month for a total of 579767.

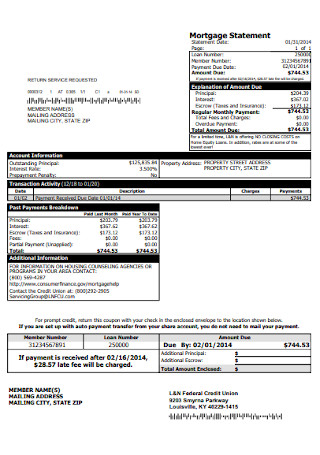

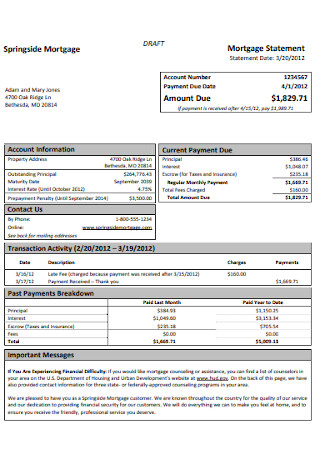

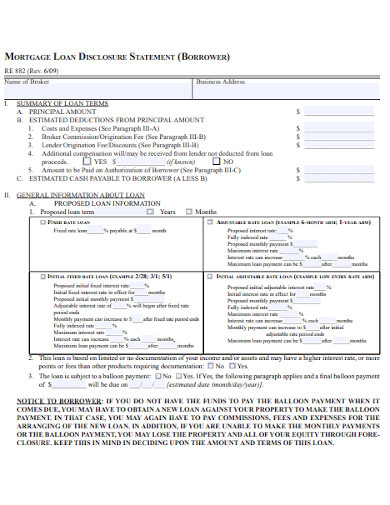

21 Sample Mortgage Statement Templates In Pdf Ms Word

Make a 13th payment each year.

. The addition of just a few hundred dollars each month can cut years from the time it takes you to pay off your mortgage. Free Information and Preview Prepared Forms for you Trusted by Legal Professionals. How much interest can you save by increasing your mortgage payment.

Find out how much interest you can save by paying an additional amount with your mortgage payment. Think that paying off your mortgage early is right for you. 800-955-0021 x2900 Mobile Home Payment Options Foreclosure Prevention CCPA Privacy Policy CCPA -.

800-955-0021 Mobile Home Loan Payoff. A common early loan payoff strategy is to make an additional principal payment each year. Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage.

Mid America Banks Early Mortgage Payoff Calculator will show you what it will take to pay off your mortgage early. The payment must be made in US currency and accompanied by an account number or the provided payment coupon. To pay off their mortgage 21 years early they made two moves to shave years off their mortgage and decrease the interest they owed.

Mortgage Refinance Calculator Early Payoff Aug 2022. Depending on your balance and how long you have left on your loan paying it off early could save you significantly on interest costs. They used a simple calculation to make 2 painless extra.

If you had a 400000 loan amount set at 4 on a 30-year fixed paying an extra 100 per month would save you nearly 30000 and youd pay off your loan two years and eight months early. The mortgage payoff calculator helps you find out. Switch To A Biweekly Payment Schedule.

Use these tips to own your home sooner. There are two ways you can make extra mortgage payments to accelerate the payoff process. Please enter original loan amount value between 01 to 9999999999.

Make a one-time payment with. Most home mortgages are 30-year fixed-rate mortgages. Most people do not know the fact that it takes 21 years to pay just half of the mortgage amount if your just pay the level monthly payment.

Lets take a look. If you paid an extra 500 per month youd save around 153000 over the full loan term and it would result in a full payoff after about 21 years and three months. Mortgage Refinance Calculator Early Payoff - If you are looking for a way to lower your expenses then we recommend our first-class service.

5 ways to pay off your mortgage early. You save money on long-term interest. One easy way to pay off your mortgage sooner is to pay your loan on a biweekly basis instead of monthly.

How Much Interest Can You Save By Increasing Your Mortgage Payment. A conforming payment is a periodic payment sufficient to cover principal interest and escrow where applicable for a given billing cycle. Homeowners Dream of Owning a Home with no Mortgage Loan Balance.

A variation is to divide the regular payment amount by 12 and add that amount to each monthly payment. At 21st Mortgage there are several methods to assist in making your loan payment. Ive been asked dozens of times to share how far along I am in my mortgage pay off journey so today Im going to share my debt pay off progress after 2 years.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. Paying Off Mortgage Early before the end of the term of the home loan is every homeowners dream. There are several ways that you can pay off your mortgage sooner that the term of your contract.

Paying your mortgage early requires dedication and proper strategic planning. Make Your Mobile Home Payment. For example if your monthly mortgage payment is 1000 youd pay 500 every 2 weeks instead of 1000 at the.

Use Casaplorers amortization calculator to understand how the amortization process works and how it affects your interest costs. Click the View Report button to see a complete amortization payment schedule and how much you can save on your mortgage. If you pay the minimum amount due every month it will take you 30 years to pay off the outstanding loan amount.

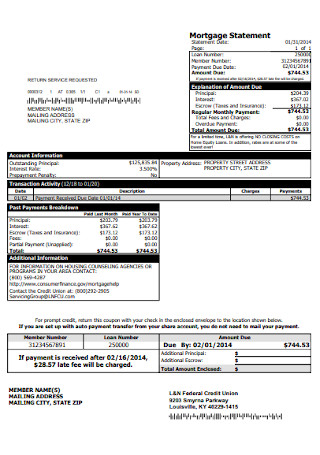

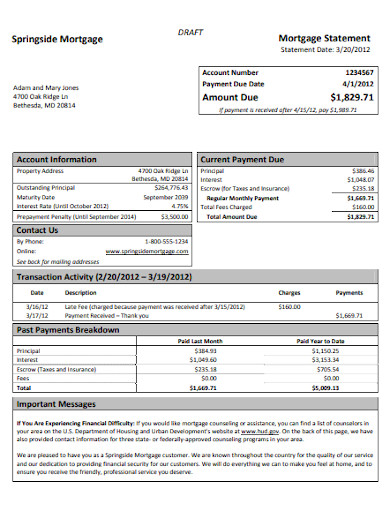

Mortgage Statement 10 Examples Format Pdf Examples

Monthly Payment Contract Template Free Loan Agreement Templates Word Pdf Lab Contract Template Personal Loans Lettering

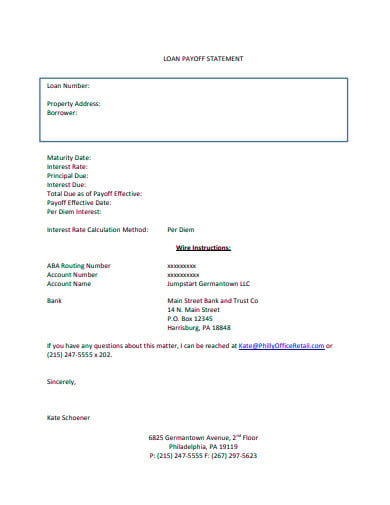

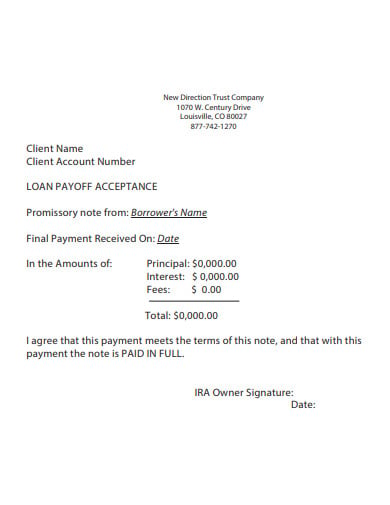

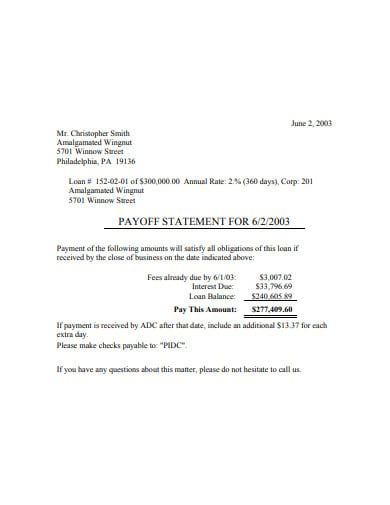

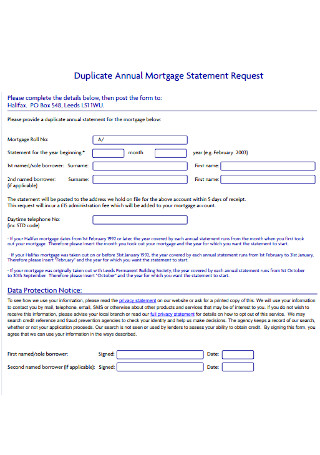

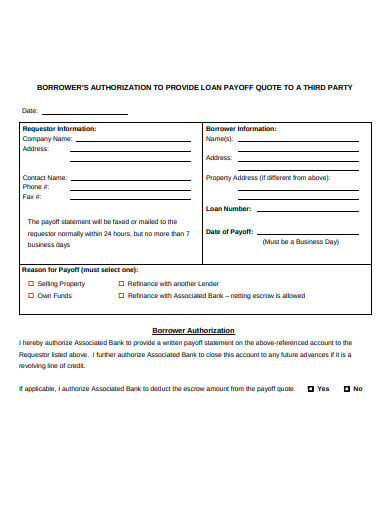

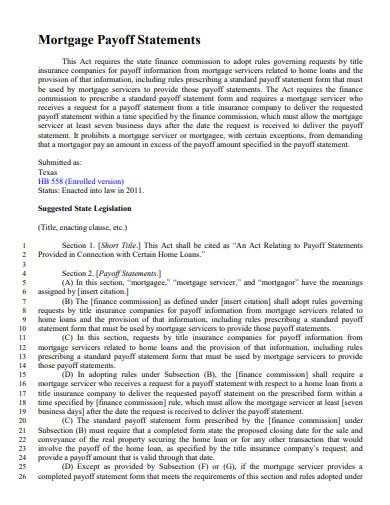

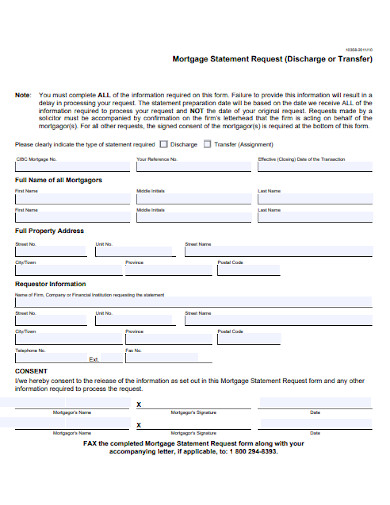

13 Payoff Statement Templates In Pdf Free Premium Templates

13 Payoff Statement Templates In Pdf Free Premium Templates

13 Payoff Statement Templates In Pdf Free Premium Templates

21 Sample Mortgage Statement Templates In Pdf Ms Word

21 Mortgage Statistics That Come As No Surprise In 2022

21 Sample Mortgage Statement Templates In Pdf Ms Word

13 Payoff Statement Templates In Pdf Free Premium Templates

Handover Certificate Template 13 Templates Example Templates Example Certificate Templates Blank Certificate Template Templates

Mortgage Statement 10 Examples Format Pdf Examples

Pros And Cons Of Downsizing Your Home Downsizing Financial Independence Retire Early Financial Independence

Mortgage Statement 10 Examples Format Pdf Examples

21 Sample Mortgage Statement Templates In Pdf Ms Word

How To Celebrate Paying Off Your Mortgage Early Mortgage Budget Planning Mortgage Free

Mortgage Statement 10 Examples Format Pdf Examples

Mortgage Statement 10 Examples Format Pdf Examples